![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

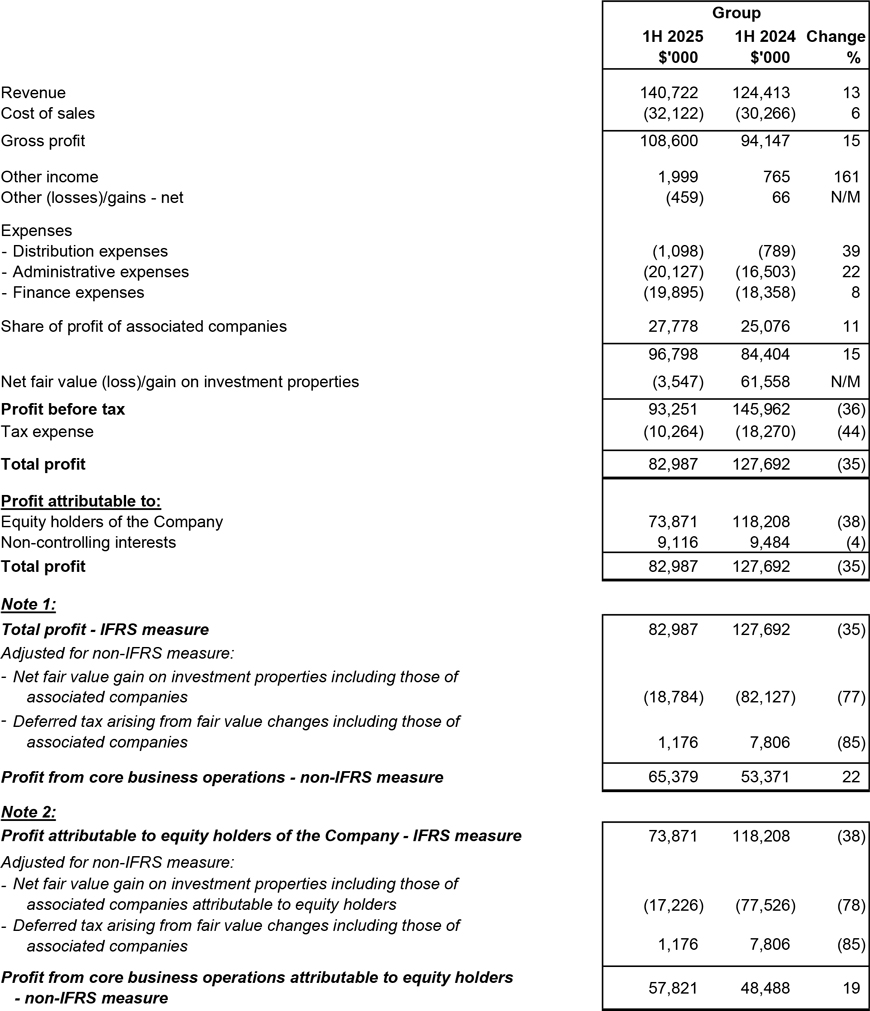

Condensed Interim Consolidated Income Statement

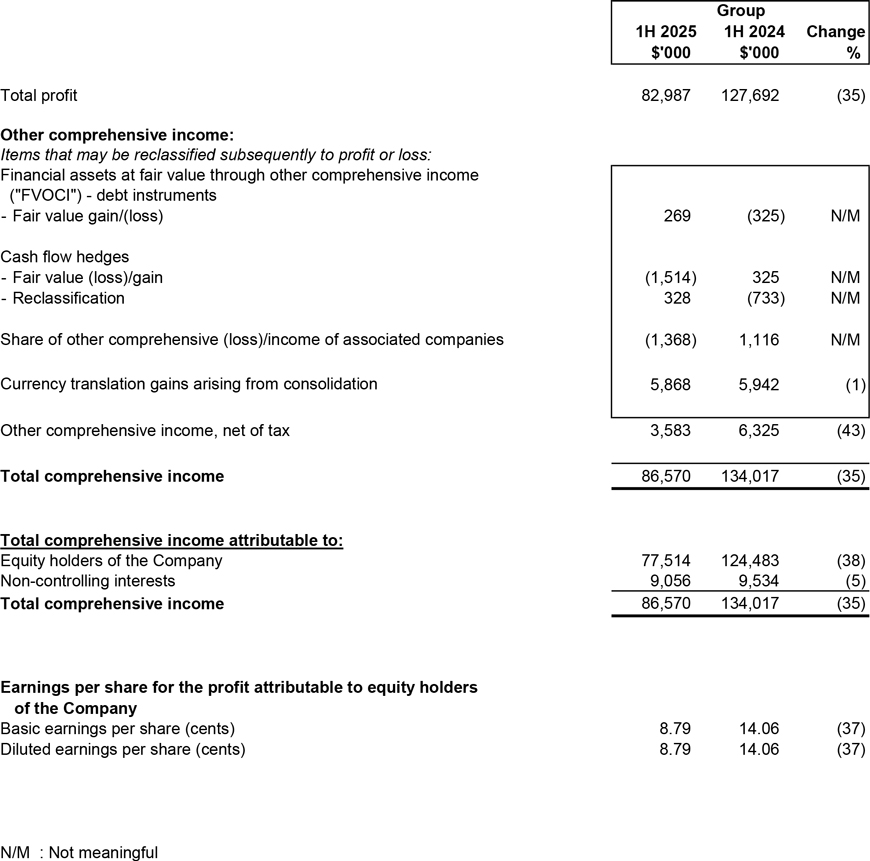

Condensed Interim Consolidated Statement of Comprehensive Income

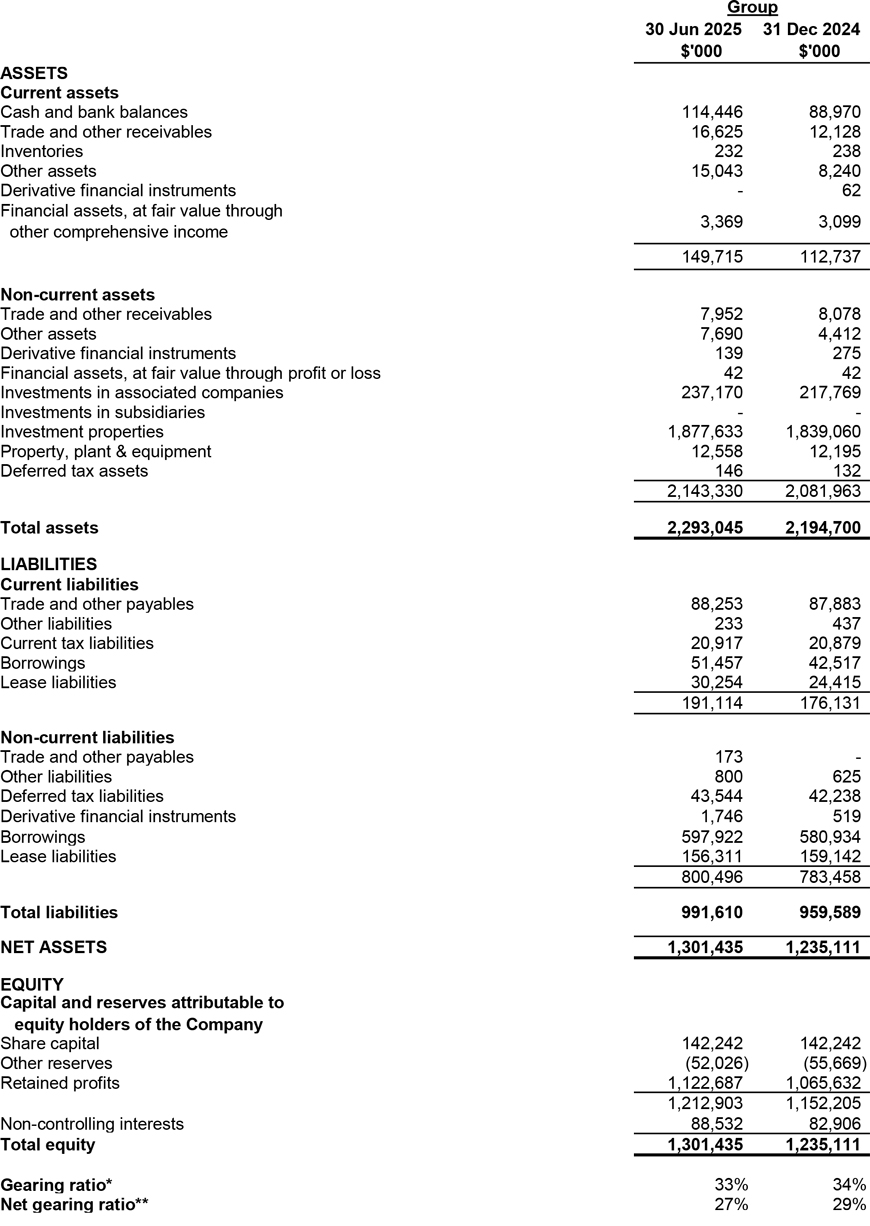

Condensed Balance Sheets

* The gearing ratio is computed as borrowings divided by total capital. Total capital is calculated as borrowings

plus net assets of the Group.

** The net gearing ratio is computed as borrowings less cash and bank balances divided by total capital.

Group Performance Review

(a) First half review – 1H 2025 vs 1H 2024

The Group registered a 13% growth in revenue to S$140.7 million in the first half-year ended 30 June 2025 ("1H 2025"), from S$124.4 million reported in the first half-year ended 30 June 2024 ("1H 2024").

The higher Group revenue was largely attributable to the continued positive rental rate revisions across the Group's global portfolio as well as Westlite Ubi which started operations in December 2024.

Financial occupancy for the Group's Singapore Purpose-Built Worker Accommodation ("PBWA"), which consists of five Purpose-Built Dormitories ("PBDs") and four Quick Build Dormitories ("QBDs") was 99.5% in 1H 2025 as compared to 99% in 1H 2024. This excludes Westlite Ubi which became operational in December 2024 and reached full occupancy towards the end of April 2025. Revenue from Singapore increased 17% or S$14.1 million from S$85.1 million to S$99.2 million in 1H 2025 mainly due to positive rental rate revisions and additional contribution from Westlite Ubi.

In Malaysia, the average financial occupancy was 83% in 1H 2025. This is a reduction from 91% in 1H 2024 excluding unavailable beds from asset enhancement initiatives ("AEIs") and new beds added, primarily due to the foreign worker cap implemented by the Malaysian authorities. The decrease in financial occupancy was offset by positive rental rate revisions and a stronger Malaysian Ringgit which translated to a positive currency impact. As a result, revenue from Malaysia declined marginally by S$14,000 to S$9.5 million in 1H 2025.

In the United Kingdom ("UK"), revenue increased by 8% to S$22.5 million in 1H 2025, up from S$20.8 million in 1H 2024. The revenue growth was supported by positive rental rate revisions, although partially offset by a slight decline in occupancy from 99% in 1H 2024 to 97% in 1H 2025.

In Australia, revenue decreased to S$7.7 million in 1H 2025 from S$8.2 million in 1H 2024. This was mainly due to the weaker Australian dollar, which resulted in a negative currency translation impact. In Australian dollar, the revenue decreased only by A$0.1 million. Financial occupancy of the Group's two assets had reduced from 94% in 1H 2024 to 91% in 1H 2025 as a result of stricter international student visa management measures and the ongoing AEIs in Melbourne. The drop in occupancy was offset by positive rental rate revisions.

Consequently, the Group's gross profit increased S$14.5 million or 15% from S$94.1 million in 1H 2024 to S$108.6 million in 1H 2025, in-line with revenue growth.

Other income and other (losses)/gains increased S$0.7 million largely due to higher interest income earned.

Distribution and administrative expenses increased by S$3.9 million, mainly due to an increase in manpower costs, technology-related expenses, as well as higher marketing and advertising activities resulting from increased business operations.

Finance expenses increased by S$1.5 million mainly due to the higher interest in lease liabilities with the commencement of master leases on assets in Malaysia, Hong Kong and Xiamen, China. This was partially offset by a reduction in loan interest rates and reduced loan balances.

Share of profit of associated companies increased by S$2.7 million, largely due to higher fair value gain on investment property and higher contribution from the Group's share in Westlite Mandai which reported a positive rental rate revision.

Net change in fair value of investment properties in 1H 2025 mainly relates to the valuation movements on the Group's investment properties as at 30 June 2025, based on management assessments made in consultation with the independent valuers who had carried out the valuation of the investment properties as at the last financial year end, as well as the adjustment of fair value of right-of-use ("ROU") investment properties that were leased as at 30 June 2025, in accordance with SFRS(I) 16 Leases.

The net fair value loss of S$3.5 million in 1H 2025 was mainly due to the adjustment of fair value of the ROU investment properties amounting to S$14.6 million which is offset against the fair value gain arising from investment properties in Singapore, Australia and UK aggregated at S$11.1 million. This was compared to a fair value gain of S$61.6 million in 1H 2024 arising mainly from investment properties in Singapore and UK.

Income tax expenses reduced S$8.0 million largely due to the decreased deferred tax from fair value changes of investment properties.

Accordingly, net profit after tax derived from the Group's operations for 1H 2025 was S$83.0 million, a decrease from S$127.7 million in 1H 2024 as a result of lower fair value gains on investment properties recorded in 1H 2025.

Excluding the net fair value adjustments of S$18.8 million, which represents 23% of net profit after tax for 1H 2025 at S$83.0 million, net profit derived from core business operations was S$65.4 million in 1H 2025, which was S$12.0 million or 22% higher than the S$53.4 million reported in 1H 2024.

(b) Review of Group Balance Sheet

Cash and Bank Balances increased by S$25.5 million, largely due to cashflow generated from operations and the proceeds from the issue of additional fixed rate notes under the Multicurrency Debt Issuance Programme ("MTN Programme"). Refer to consolidated statement of cashflows for details.

Trade and other receivables increased by S$4.4 million, largely due to advances made to participate in projects that are under evaluation.

Other assets (current and non-current) increased by S$10.1 million, mainly from payments of deposits incurred for potential investments.

Investment in associated companies increased by S$19.4 million due to the profits derived by the associated companies resulting from fair value gains and better operating performance.

Investment properties increased by S$38.6 million largely due to the lease extension of a leased asset as well as AEI carried out in Westlite Toh Guan, dwell Village Melbourne City and assets in Malaysia.

Borrowings & Gearing

The Group's borrowings increased from S$623.5 million as at 31 December 2024 to S$649.4 million as at 30 June 2025, due primarily to the new fixed rate notes issued on 31 January 2025.

The Group's net gearing ratio was 27% as at 30 June 2025, as compared to 29% as at 31 December 2024. The Group's acquired operating assets and assets under development are primarily funded through bank borrowings, which have an average remaining maturity profile of 6 years. The Group uses long-term bank debt with regular principal repayments to finance its long-term assets.

As at 30 June 2025, the Group's balance sheet remained healthy with S$114.4 million in cash and bank balances. The Group has unutilised committed credit facilities of S$153.5 million (of which S$146.5 million relates to unutilised committed credit facilities expiring more than 12 months after balance sheet date) to meet the net current liabilities of S$41.4 million as at 30 June 2025.

(c) Review of Company Balance Sheet

Cash and bank balances are higher by S$11.6 million and borrowings are higher by $38.4 million due to the additional fixed rate notes issued under the MTN Programme.

Trade and other receivables as well as trade and other payables mainly relate to intercompany balances with subsidiaries.

(d) Review of Statement of Cash Flows

In 1H 2025, the Group generated a positive cash flow of S$69.8 million from operating activities.

Net cash used in investing activities amounted to S$13.7 million, mainly due to AEI activities carried out on investment properties.

The Group recorded net cash used in financing activities of S$30.5 million mainly due to proceeds from issue of additional fixed rate notes under the MTN Programme, offset against repayment of borrowings, interest, principal portion of lease liabilities and dividends paid during 1H 2025.

Commentary On Current Year Prospects

As of 30 June 2025, Centurion operates a diversified portfolio of 37 operational Purpose-Built Worker Accommodation, Purpose-Built Student Accommodation, and Build-to-Rent assets ("PBWA", "PBSA" and "BTR" respectively), comprising c.70,291 beds across Singapore, Malaysia, Australia, China, the United Kingdom ("UK") and the United States ("US").

Workers Accommodation

Singapore

In Singapore, the Group operates ten PBWA with a total capacity of c.36,438 beds, comprising six Purpose-Built Dormitories ("PBDs") with c.29,182 beds and four Quick Build Dormitories ("QBDs") with c.7,256 beds. Average financial occupancy rates for 1H 2025 remained high at 99%, underpinned by resilient demand from a diversified and stable customer base across the Group's worker accommodation portfolio.

The demand for worker accommodation continues to be backed by strong construction sector fundamentals, with the Building and Construction Authority ("BCA") projecting total construction demand to be in the range of $47 billion to $53 billion in 2025, up from $44.2 billion in 2024. BCA also expects total construction demand in the public and private sectors to stay high at between $39 billion and $46 billion per year from 2026 to 2029 supported by large-scal infrastructure projects such as Changi Airport Terminal 5, Cross Island Line and development of public and private housing.1

Reflecting this continued resilience, the Ministry of Trade and Industry ("MTI") reported that Singapore's construction sector expanded by 4.9% year-on-year in the second quarter of 2025, easing slightly from the 5.1% growth in the preceding quarter. Growth during the quarter was supported by an increase in public sector construction output.2

Furthermore, with the impending Dormitory Transition Scheme ("DTS") for existing dormitories to comply with the Interim Dormitory Standards ("IDS") by year 2030 and the New Dormitory Standards ("NDS") by year 2040, announced by the Ministry of Manpower ("MOM") in October 2023, the overall market inventory of dormitory beds is expected to decline.3

The Group has Asset Enhancement Initiatives ("AEIs") underway to develop new blocks at Westlite Toh Guan ("WTG") and Westlite Mandai ("WTM"), adding c.1,764 new beds by 4Q 2025 and c.3,696 new beds by Q1 2026 that will comply with NDS, respectively. The AEI not only mitigates any expected loss in bed capacity of WTG and WTM due to IDS and NDS but increases the overall net bed capacity in these two PBDs. These new blocks are intended to serve as "swing sites" while other existing blocks and PBDs within the Group undergo retrofitting works to comply with IDS. The application of the AEI has provided a capacity cap at 8,430 beds and 8,006 beds of WTG and WTM respectively that complies with expected IDS and NDS ahead of time.

Separately, in view of the demands for bed supply in the market, the Group is working with MOM and has submitted applications to the relevant government agencies and authorities to lift the capacity restrictions that allows the existing old blocks, similar to all existing dormitories in Singapore, to comply with existing standards till 2030. Upon success, the available bed capacity of WTG and WTM will increase by approximately 660 beds and 1,980 beds respectively, relieving the acute shortage of the PBWA beds in Singapore.

As of 1H 2025, the Group's PBDs are already compliant with some key specifications of the NDS, including ensuite toilets and showers in every apartment unit. The Group expects to incur about S$5.7 million over a period of 4 years to do renovation and retrofitting works to comply with IDS in 2030.

The Group continues to explore and expand its portfolio of PBWA beds in Singapore, through AEIs that will deliver a steady supply of newly constructed and redeveloped PBD beds, all fully compliant with MOM's regulatory standards.

Malaysia

In Malaysia, the Group operates eight PBWAs across Johor, Penang, and Selangor, with a total capacity of c.28,413 beds. These three states remain hotspots for working housing investment amid an undersupply. The rapid expansion of manufacturing and logistics hubs in these high-demand industrial regions is driving workforce housing needs4.

Excluding unavailable beds from AEIs and new beds added, the average financial occupancy stood at 83% in 1H 2025, down from 91% in 1H 2024. The decline was mainly due to the foreign worker cap implemented by the Malaysian authorities, as well as the government having made available a supply of temporary labour quarters ("TLQ") with licences ranging from 1 to 3 years to relieve the shortage of available PBWAs.

To address labour shortages, the Malaysia government has implemented a policy allowing foreign workers in formal sectors to switch employers across different industries. This move has been widely welcomed by industry stakeholders as both practical and timely. The formal sectors covered under the policy include manufacturing, construction, agriculture, plantations, and services.5

Concurrently, the government continues to strengthen enforcement of the Minimum Standards of Housing, Accommodation, and Employee Facilities Act 1990. In 2024, the Department of Labour Peninsular Malaysia issued 637 compound notices amounting to approximately RM4.01 million to employers who failed to safeguard the welfare and basic needs of their workers.6

Despite ongoing challenges in labour supply, demand for high-quality PBWAs remains resilient, underpinned by industry needs. The Group remains committed to upholding regulatory compliance and maintain high standards amid shifting labour dynamics. The Group is working closely with the local authorities and JTKSM over the supply and available PBWAs beds within the Group so that they could make an informed decision over their process of renewing licenses for TLQs.

The Group remains optimistic about the long-term growth of PBWA in the Malaysian market. AEI works are currently underway at Westlite Johor Techpark, where c.360 beds were added in 1H 2025 and an additional c.510 beds are expected to be added in 2H 2025. The Group is also exploring expansion opportunities in Malaysia via potential acquisitions as well as the development of a new PBWA in Nusajaya, Iskandar, Johor, with a proposed development of c.7,000-bed PBWA.

Hong Kong SAR, China

Following the Group's expansion into the Hong Kong SAR, China, its c.539-bed PBWA asset, Westlite Sheung Shui, has been housing foreign workers across multiple sectors, including Food & Beverage ("F&B") and services. Average financial occupancy rates for 1H 2025 rose to 28%, compared to 25% in 1Q 2025, and is expected to ramp up gradually following the completion of refurbishment works for 451 operational beds in 1Q 2025.

Since the launch of the Enhanced Supplementary Labour Scheme ("ESLS"), the Hong Kong government has approved over 54,000 non-local workers between early September 2023 and March 2025. The number of applications under the scheme has exceeded 100,000, reflecting strong demand for foreign labour7.

Centurion's strategic expansion is well-positioned to support the growing accommodation needs for non-local workers in the Special Administrative Region.

Student Accommodation

As of 30 June 2025, the Group manages a portfolio of c.4,501 beds across 17 operational PBSA assets in Australia, the UK, the US, and Hong Kong SAR China. Underpinned by favourable demand-supply dynamics, demand for student housing in Centurion's operating markets is expected to remain resilient despite industry headwinds, including tightened visa applications.

United Kingdom

The Group operates ten PBSA assets in UK cities anchored by Russell Group universities, with a total bed count of c.2,786 beds. In 1H 2025, the Group maintained a strong financial occupancy rate of 97%, a slight moderation from 99% in 1H 2024.

According to CBRE, the UK PBSA sector continues to experience a persistent demand-supply imbalance. While 14,000 new beds are expected to be added in 2025, this remains below the historical annual average of 30,000 beds. Investor sentiment remains strong, driven by consistently strong returns and the availability of income- generating opportunities, which continue to attract both new and returning capital.8

Further supporting the sector's outlook, the latest UK study visa application data released in late May 2025 showed that nearly 47,000 main applicants submitted a study visa application in 1Q 2025, a 32% increase over 1Q 2024. Additionally, over 48,000 study visas were issued during the same period, marking a 27% year-on-year increase, reflecting renewed confidence among international students in the UK.9

Australia

The Group's PBSA portfolio in Australia, comprising c.897 beds at dwell Village Melbourne City and dwell East End Adelaide, recorded a dip in average financial occupancy to 91% in 1H 2025, down from 94% in 1H 2024. The Group observed a delay in student arrivals for Academic Year 2025, due to international student visa management measures. After the commencement of FY2025 Semester 1, occupancy rebounded strongly to 93% in 2Q 2025.

Australia's PBSA sector continues to face headwinds, including the recent increase in student visa application fees and proposed policy measures aimed at curbing the growth of international student numbers. While these developments have dampened sentiment, sector leaders remain optimistic. Education institutions are lobbying for lower visa fees, particularly for short-term students10. In a positive move, the Australian government has recently lifted the foreign student cap to 295,000, prioritising applicants from South-east Asia11.

The Reserve Bank of Australia ("RBA") has also noted that the increased inflow of international students is placing upward pressure on rental demand in education hubs and has driven a supply response in the form of rapid growth in PBSA approvals in recent years.12

Amid these dynamics, the Group continues to be positive on the Australia PBSA sector in the long term. To capture broader segments of student demand, the Group has launched EPIISOD, a new premium PBSA brand. EPIISOD's first development, a c.732-bed property in Macquarie Park, Sydney, is expected to be completed by 1Q 2026 ahead of Semester 1, Academic Year 2026. The development will bring much-needed capacity and diversity in student housing choices to the Macquarie Park and Sydney CBD vicinity.

The Group continues to actively expand its broader PBSA portfolio in Australia, to further strengthen its market share in the PBSA market in Australia.

Beyond Macquarie Park, the Group has plans underway to develop more PBSA properties in Australia, bringing EPIISOD to at least four more sites in Melbourne and Perth in the coming years.

This include ongoing works at dwell Village Melbourne City, where an existing car park is being redeveloped into a new block with approximately 644 beds, slated for completion in 1Q 2027. The Group has also commenced planning applications for a new c.675-bed PBSA development on a land site near RMIT University in Melbourne.

United States

The Centurion US Student Housing Fund ("CUSSHF" or "Fund") reached term in November 2024. The Fund has sold dwell Tenn Street in 2Q 2023, and dwell Logan Square and dwell Stadium View in 2Q 2024. The remaining three assets maintain healthy occupancies and will be disposed of in due course.

Hong Kong SAR, China

The Group has begun leasing its student accommodation properties, dwell Prince Edward and dwell Ho Man Tin, which collectively holds c.155 beds. The average financial occupancy rate in 1H 2025 stood at 40%, with occupancy expected to ramp up over time as the new academic year begins in 3Q 2025.

To enhance its position as a global education hub, the Hong Kong government has introduced several initiatives to strengthen the local and international business landscape. These include the development of an International Hub for Post-secondary Education, which leverages the city's strong academic infrastructure and aims to boost enrolment of non-local students13.

Despite government efforts such as the Hostel Development Fund, the total projected supply of student accommodation in Hong Kong, including both private and University Grants Committee (UGC)-funded options, is expected to reach approximately 55,000 beds by 2028. In contrast, demand is projected to rise to approximately 175,000 beds, driven by accommodation needs from 25% of local full-time students and all non-local full-time students in post-secondary programmes, reinforcing the need for PBSA supply14.

Build-To-Rent

In 2024, Centurion made its maiden entry into China's Build-to-Rent ("BTR") market, expanding into a new living accommodation asset class. The BTR sector is dedicated to the development and management of properties for long-term rental, addressing the growing demand for high quality rental housing.

Xiamen, China

The Group's first BTR project, located in Gaolin, Huli District, is being retrofitted into premium apartments targeted at fresh graduates and professionals in Xiamen. Approximately 400 units have been secured under a 20-year master leases and commenced operations following retrofitting works, in 2025.

Average financial occupancy for the BTR portfolio stood at 47% in 1H 2025. The Group will continue to monitor market conditions and performance before committing to potential further portfolio expansion in the city.

Looking Ahead

The global landscape remains volatile, marked by evolving trade dynamics and escalating geopolitical tensions. Against this backdrop, the Group remains confident that its portfolio of stable, resilient assets will continue to perform. The counter-cyclical nature of the education sector, along with investor interest in worker accommodations driven by high yields, and positive demand-supply dynamics, further reinforces the Group's positioning. These structural strengths continue to anchor the Group's stable performance across its operating markets.

Centurion remains committed to a strategic and prudent approach in growing its living sector accommodation platform. This includes enhancing project returns through selective AEIs, expanding recurring revenue streams, and pursuing strategic acquisitions in both existing and new markets, supported by capital recycling to enable scalable growth of the Group's assets under management.

A key milestone ahead is the proposed listing of Centurion Accommodation Real Estate Investment Trust ("CAREIT") on the Main Board of the Singapore Exchange. The Company had on 10 June 2025 announced its "Submission Of Listing Application To The SGX-ST And Various Applications To The MAS, In Respect Of Proposed REIT Listing", and on 14 July 2025 announced its "Entry Into Letter Agreements In Connection With The Proposed Listing Of Centurion Accommodation REIT". (Details of these announcements may be found on SGX-Net and on the Company's website's Investor Relations section.)

The proposed CAREIT listing is an integral part of the Group's strategy to grow its asset under management in its living sector business.

In parallel, the Group will continue to pursue asset light strategies, including joint ventures, master leases, and private investment funds, driving continued value creation in a dynamic market environment.

Remarks:

1. Construction Demand To Remain Strong For 2025, Building and Construction Authority (BCA), 23 January 2025

2. Singapore's GDP Grew by 4.3 Per Cent in the Second Quarter of 2025, Ministry of Trade and Industry Singapore, 14 July 2025

3. Worker Dormitories in Singapore H2 2024, Dormitory Association Singapore Ltd & Knight Frank Singapore, Feb 2025

4. Workers' Accommodation: The Shift towards Sustainable and Compliant Housing, Zerin Properties Research, 1 January 2025

5. Cross-sector job moves approved for foreign workers, The Star, 10 May 2025

6. JTKSM: 637 compounds worth RM4.01 million issued to errant employers last year, The Sun, 22 April 2025

7. Over 54,000 non-local workers approved to work under 'enhanced' labour scheme, Hong Kong gov't says, Hong Kong Free Press, 16

Apr 2025

8. Crisis or opportunity? The UK student housing shortage, CBRE, 4 Jul 2024

9. Second Straight Quarter of Stabilised International Student Demand for a UK Study Visa, Higher Education Policy Institute, 24 June

2025

10. Australia's education leaders push for lower student visa fees for short-term students, The PIE News, 23 July 2025

11. Australia lifts foreign student cap to 295,000 and prioritises South-east Asia, The Business Times, 4 August 2025

12. International Students and the Australian Economy, Reserve Bank of Australia, 24 July 2025

13. Hong Kong universities drive market shift: strategic acquisitions for student housing, Colliers, 25 February 2025

14. Bridging the Gap: Colliers Calls for Action on Hong Kong's Student Housing Shortage, Colliers, 2 September 2024