This printed article is located at https://centurion.listedcompany.com/financials.html

Financial Statements

![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

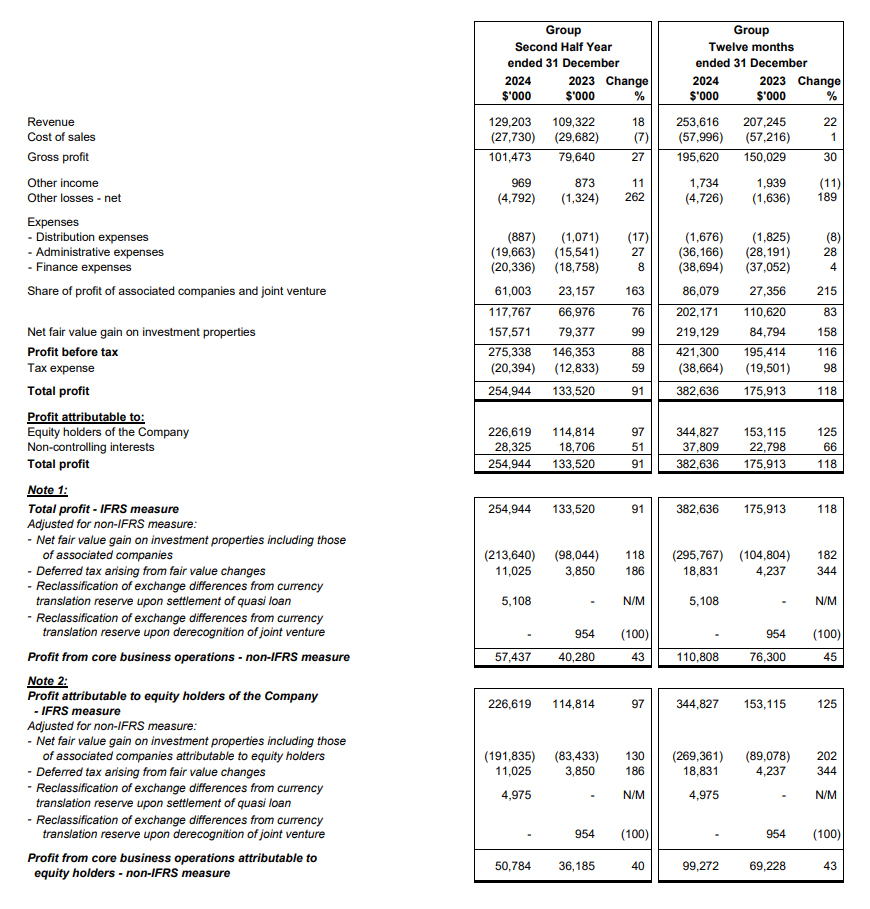

Condensed Interim Consolidated Income Statement

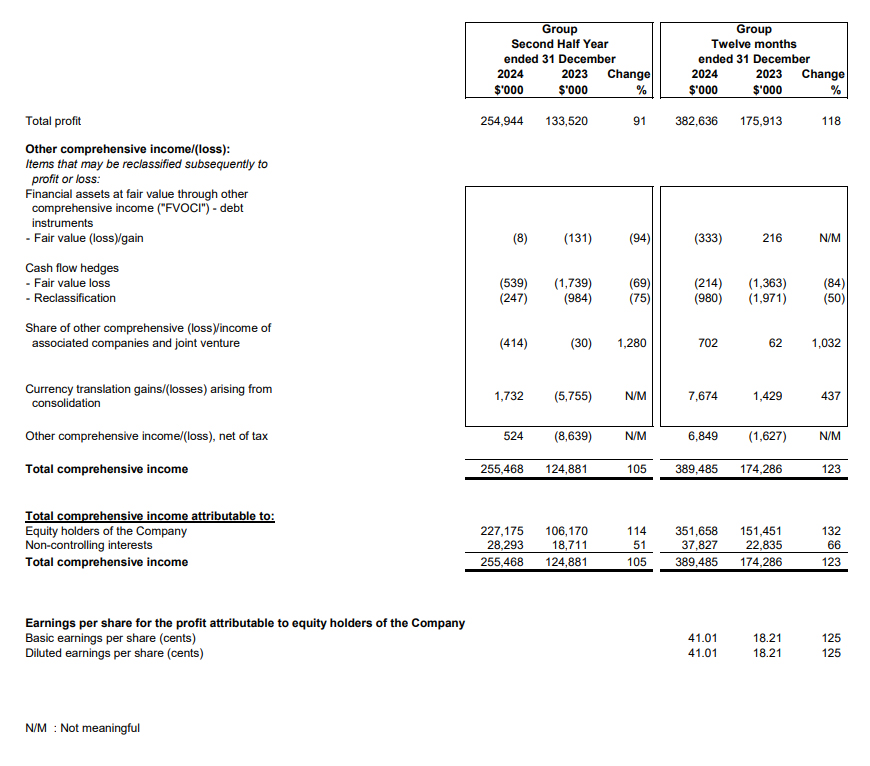

Condensed Interim Consolidated Statement of Comprehensive Income

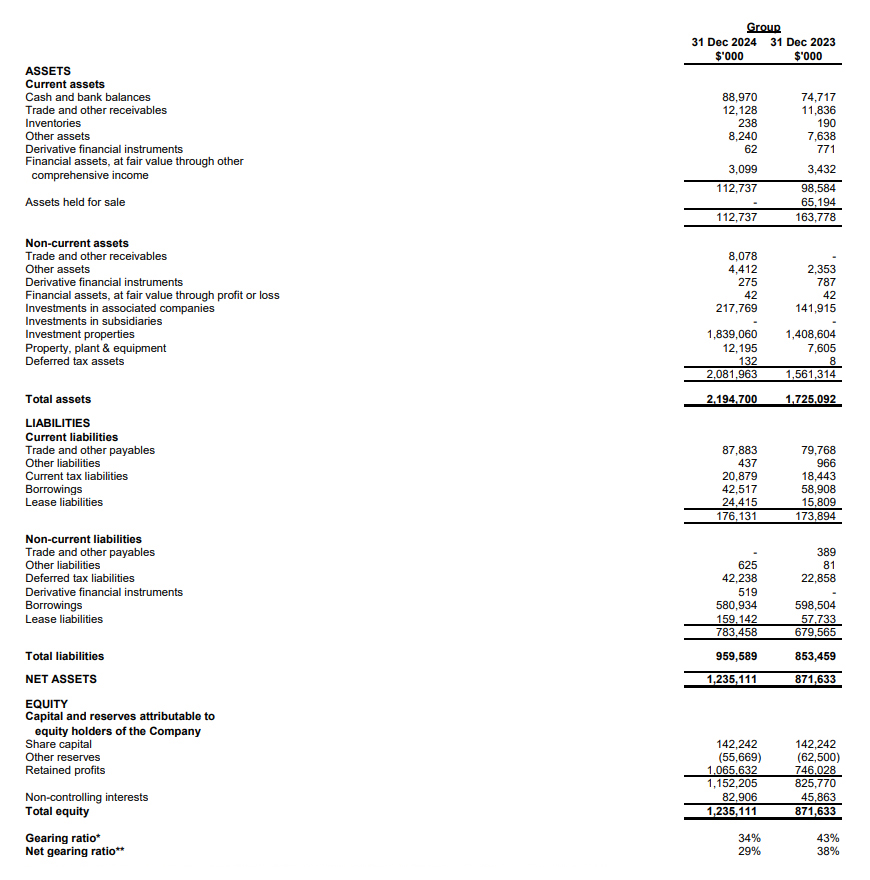

Condensed Balance Sheets

* The gearing ratio is computed as borrowings divided by total capital. Total capital is calculated as borrowings

plus net assets of the Group.

** The net gearing ratio is computed as borrowings less cash and bank balances divided by total capital.

Group Performance Review

(a)(i) Second half review – 2H 2024 vs 2H 2023

The Group’s revenue increased 18% to S$129.2 million in the second half year ended 31 December 2024 (“2H 2024”), from S$109.3 million in the second half year ended 31 December 2023 (“2H 2023”).

The higher Group revenue was attributable to the continued positive rental rate revisions in both Purpose-Built Workers Accommodation (“PBWA”) and Purpose-Built Student Accommodation (“PBSA”) portfolio globally as well as increased occupancies across its properties in Singapore and Australia.

Financial occupancy for the Group’s Singapore PBWA, which consists of five Purpose-Built Dormitories (“PBDs”) and four Quick Build Dormitories (“QBDs”) increased from 99% in 2H 2023 to almost 100% in 2H 2024. Revenue from Singapore increased 23% or S$16.8 million as tenancies renewed at higher prevailing rates since 3Q 2023 progressively contributed higher revenue in 2H 2024. Increases in ancillary services, primarily from the provision of environmentally-friendly white goods (such as refrigerators and washing machines) to residents as part of the Group’s sustainability initiatives, also contributed to the revenue growth.

In Malaysia, the average financial occupancy was 85% in 2H 2024 (or 91% when excluding beds unavailable in the current half-year due to ongoing Asset Enhancement Initiatives ("AEI")). This is a reduction from 92% in 2H 2023, primarily due to beds being temporarily taken offline for Westlite Senai II AEI works. Despite the lower occupancy, Malaysia revenue reported an increase of S$0.2 million or 2% in 2H 2024 with strong rental rate revisions, especially for apartments units enhanced in recent AEIs, as compared to 2H 2023.

In the United Kingdom ("UK"), UK revenue reported in 2H 2024 increased 15% to S$19.3 million, compared to S$16.8 million in 2H 2023, primarily supported by positive rental revisions.

In Australia, average financial occupancy of the Group’s Adelaide and Melbourne assets improved from 90% in 2H 2023 to 98% in 2H 2024 supported by the ongoing shortage of beds. Australian PBSA revenue grew 6%, also boosted by healthy rental revisions.

The Group’s gross profit increased S$21.8 million or 27% from S$79.6 million in 2H 2023 to S$101.5 million in 2H 2024 driven primarily by revenue growth stemming from improvements in financial occupancy and rental rates.

In 2H 2024 under other losses, the Group reclassified currency exchange loss of S$5.1 million from currency translation reserve to Income Statement upon settlement of shareholder loan with proceeds from the sale of two investment properties to Kumpulan Wang Persaraan (Diperbadankan) (“KWAP”) in Malaysia.

Administrative and distribution expenses increased by S$3.9 million mainly due to increase in manpower costs, legal and professional fees as well as technology related expenses resulted from the increase in business operations.

Finance expenses increased by S$1.6 million due to the higher interest in lease liabilities with the commencement of leases from KWAP on Westlite Tampoi and Westlite Bukit Minyak as well as the three master leases in Hong Kong, China. This was partially offset by a reduction in loan balances amidst a higher interest rate environment.

Share of profit of associated companies and joint venture increased by S$37.8 million, largely due to fair value gain on investment property as well as higher rental rate in Westlite Mandai.

A fair valuation exercise was conducted by independent valuers on the Group’s investment properties as at 31 December 2024, and a net fair value gain reflecting current market conditions of S$157.6 million was recognised in 2H 2024, compared to a gain of S$79.4 million in 2H 2023.

Income tax expenses rose S$7.6 million in line with higher profits and deferred tax arising from fair value changes.

Accordingly, net profit after tax derived from the Group’s operations for 2H 2024 was S$254.9 million, 91% higher compared to S$133.5 million in 2H 2023.

Net profit derived from core business operations was S$57.4 million in 2H 2024 which was S$17.2 million or 43% higher than the S$40.3 million reported in 2H 2023.

(a)(ii) Full year review – FY 2024 vs FY 2023

The Group registered a 22% growth in revenue, from S$207.2 million in the year ended 31 December 2023 (“FY 2023”) to S$253.6 million in the year ended 31 December 2024 (“FY 2024”). This was attributable to positive rental rate revisions across the Group's global portfolio, as well as improved occupancies in the Singapore, UK, and Australia markets.

Revenue from Singapore in FY 2024 was S$176.1 million compared to S$137.9 million in FY 2023, as a result of better financial occupancy at 99% in FY 2024 and positive rental rate revisions, and also higher provision of ancillary services including the provision of environmentally-friendly white goods to residents as part of the Group’s sustainability efforts to reduce water and electricity consumption.

Malaysia revenue reduced S$0.2 million due primarily to the weaker Malaysian ringgit in FY 2024 as compared to FY 2023, which translated to a lower revenue when reported in Singapore dollars. However, in local currency of Malaysian ringgit, revenue was similar to FY 2023 which was driven by positive rental revisions. The revenue growth, despite a reduction in financial occupancy from 93% in FY 2023 to 91% (excluding beds unavailable due to AEI at Westlite Senai II) in FY 2024, was achieved with strong rental rate revisions, particularly from enhanced apartment units.

UK PBSA revenue increased 20% or S$6.8 million compared to FY 2023. This was driven by a higher financial occupancy of 98% up from 93% in FY 2023, along with positive rental revisions.

Australia PBSA revenue grew 13% from S$15.0 million to S$16.9 million with average financial occupancy increasing from 88% in FY 2023 to 96% in FY 2024 due to a stronger demand for PBSA beds.

In line with the higher sales, the Group’s gross profit increased S$45.6 million or 30% from S$150.0 million in FY 2023 to S$195.6 million in FY 2024.

Under other losses, the Group reclassified currency exchange loss of S$5.1 million from currency translation reserve to Income Statement upon settlement of shareholder loan with proceeds from the sale of two investment properties to KWAP in Malaysia.

Administrative and distribution expenses increased by S$7.8 million mainly due to increase in manpower costs, legal and professional fees as well as technology related expenses resulted from the increase in business operations.

Finance expenses increased marginally by S$1.6 million due to the commencement of master leases in FY 2024 and higher interest rate environment. This was offset by a reduction in interest expenses due to the repayment of borrowings.

Share of profit of associated companies and joint venture increased by S$58.7 million, largely due to fair value gains, positive rental rate revisions and high occupancy at Westlite Mandai.

The net fair value gain on investment properties of S$219.1 million in FY 2024 was primarily driven by the Group's investment properties in Singapore, UK, Australia and Malaysia offset by adjustments to the fair value of right-of-use (“ROU”) investment properties.

Income tax expenses increased by S$19.2 million mainly due to higher profits and increased deferred income tax from fair value changes of investment properties.

Net profit after tax for FY 2024 was S$382.6 million, an increase of S$206.7 million or 118% as compared to S$175.9 million in FY 2023. Excluding fair value adjustments and reclassification of exchange differences, net profit derived from core business operations was S$110.8 million in FY 2024, which was S$34.5 million or 45% higher than S$76.3 million in FY 2023.

(b) Review of Group Balance Sheet

Cash and Bank Balances increased by S$14.3 million largely due to proceeds received from the disposal of Westlite Bukit Minyak and Westlite Tampoi to KWAP, Malaysia’s public sector pension fund.

Assets held for sale decreased by S$65.2 million with the disposal of Westlite Bukit Minyak and Westlite Tampoi in FY 2024. Investments in associated companies increased by S$75.9 million mainly due to profits in FY 2024.

Trade and other receivables increased by S$8.4 million, mainly due to loans to an associated company to finance the development cost in Macquarie Park, Australia.

Investment properties increased by S$430.5 million largely due to the fair value gains, capitalised expenditure on assets under development, and recognition of ROU assets in Westlite Bukit Minyak and Westlite Tampoi upon the completion of the sale and leaseback with KWAP, as well as newly leased assets in Hong Kong and Xiamen, China.

Trade and other payables increased by S$7.7 million primarily due to advance rental payments received from tenants and accruals made on development projects.

Lease liabilities increased by S$110.0 million, due to the addition of ROU assets in Westlite Tampoi, Westlite Bukit Minyak, Xiamen as well as three master leases for dwell Prince Edward, dwell Ho Man Tin and Westlite Sheung Shui in Hong Kong, China. Additionally, lease extensions of at least one year for tenancies in Westlite Kranji Way, Westlite Tuas South Boulevard, Westlite Tuas Avenue 2 and Westlite Jalan Tukang were recorded.

Borrowings & Gearing

The Group’s borrowings reduced from S$657.4 million as at 31 December 2023 to S$623.5 million as at 31 December 2024, mainly due to repayment of borrowings during the year.

The Group’s net gearing ratio was 29% as at 31 December 2024, as compared to 38% as at 31 December 2023. The Group’s acquired operating assets and assets under development are primarily funded through bank borrowings, which have an average remaining maturity profile of 6 years. The Group uses long-term bank debt with regular principal repayments to finance its long-term assets.

As at 31 December 2024, the Group’s balance sheet remained healthy with S$89 million in cash and bank balances. The Group has unutilised committed credit facilities of S$150.4 million (of which S$133.9 million relates to unutilised committed credit facilities expiring more than 12 months after balance sheet date) to meet the net current liabilities of S$63.4 million as at 31 December 2024.

(c) Review of Company Balance Sheet

Trade and other receivables as well as trade and other payables mainly relate to intercompany balances with subsidiaries.

(d) Review of Statement of Cash Flows

In FY 2024, the Group generated a positive cash flow of S$153.8 million from operating activities.

Net cash used in investing activities amounted to S$20.0 million is mainly due to cash paid for property developmental projects undertaken by the Group, additions to property, plant and equipment, and investment in an associated company offset against proceeds from the disposal of Westlite Tampoi and Westlite Bukit Minyak in Malaysia.

The Group recorded net cash used in financing activities of S$121.6 million mainly due to repayment of borrowings, interest, the principal portion of lease liabilities and dividends paid during the year.

Commentary On Current Year Prospects

As at 31 December 2024, Centurion operates a diversified portfolio of 37 operational purpose-built workers accommodation, student accommodation, and build-to-rent assets (“PBWA”, “PBSA” and “BTR” respectively), comprising c.69,929 beds across Singapore, Malaysia, Australia, China, the United Kingdom (“UK”) and the United States (“US”).

Workers Accommodation

Singapore

In Singapore, the Group operates ten Purpose-Built Workers Accommodation (“PBWA”) with a total capacity of 36,436 beds, which comprise of six Purpose-Built Dormitories (“PBDs”) with c.29,180 beds and four Quick Build Dormitories (“QBDs”) with c.7,256 beds.

FY 2024 average financial occupancy rates was 99%, excluding the newly launched Westlite Ubi which is ramping up occupancy. This reflects a one percentage point increase year-on-year (“YoY”) from FY 2023.

The outlook for Singapore remains positive, with the Building and Construction Authority (“BCA”) forecasting up to $53 billion in construction contracts for 2025, and construction demand maintaining between $39 billion to $46 billion between 2026 and 2029.1

With the government’s rapid response to increase temporary bed supply during 2024, rental rate revisions are expected to moderate.2 The Group expects rental revenue growth to remain healthy, as expiring leases are renewed at prevailing market prices.

In the near to mid-term, PBD bed supply is expected to tighten between 2027 and 2030, as existing dormitories undergo retrofitting to meet mandated Interim Standards in the Dormitory Transition Scheme (“DTS”).2

The Group continues to work towards expanding its portfolio of PBWA beds in Singapore. A healthy pipeline is underway to deliver a steady supply of both newly constructed and redeveloped PBD beds, which are fully compliant with regulatory standards laid down by the Ministry of Manpower (MOM).

Westlite Ubi became operational in December 2024, adding c.1,650 beds to the Group’s portfolio. This newly developed PBWA is among the first PBDs in the market which fully comply with New Dormitory Standards.

Asset enhancement initiatives (“AEIs”) are in progress to develop a new block each at Westlite Toh Guan and Westlite Mandai, to add c.1,764 beds by December 2025 and c.3,696 beds by early 2026 respectively. As part of the Group’s transition plan to maintain bed capacity and minimise disruption during the DTS, the new blocks will serve as “swing sites” as other existing blocks undergo retrofitting works. The Group’s five other PBDs are already compliant with some of the key specifications required by 2040, such as ensuite toilets and showers in every apartment unit. In addition, the Group has secured lease extensions for its four QBDs.

Malaysia

In Malaysia, the Group manages eight PBWAs located in Johor, Penang, and Selangor, comprising c.28,053 beds. The three states host Malaysia’s largest population of foreign manufacturing workers, making up roughly 35% of Malaysia’s foreign workers.3 The average financial occupancy for FY 2024 declined from 93% to 91% in FY 2023, excluding beds unavailable during an AEI at Westlite Senai II and beds newly added on completion of the AEI.

Demand for high-quality PBWAs remains strong, driven by continuing enforcement of the Minimum Standards of Housing, Accommodation and Employee Facilities Act 1990 (“Act 446”). The Group still observes some short-term headwinds from the foreign worker cap4, but there has been growing pressure on the government to raise the threshold5. The Johor Government continues to emphasise that employers should provide Centralised Labour Quarters (“CLQ”) for migrant workers, in compliance to Act 446.6

To tap growing demand, the Group is undertaking AEI works at Westlite Johor Techpark adding c.870 beds in 2025 and exploring potential development plans for c.7,000 beds in Nusajaya, Iskandar, Johor.

Hong Kong SAR, China

In July 2024, the Group expanded its specialised worker accommodation business into Hong Kong SAR, China with an accommodation for foreign workers, mainly in the food & beverage ("F&B") and service sectors. Westlite Sheung Shui is now operational, with c.539 beds. The Group expects the occupancy to ramp up gradually.

It is projected that there will be a shortage of 180,000 workers in the next five years. With the implementation of the Enhanced Supplementary Labour Scheme (“ESLS”) in 2023, more than 43,000 foreign laborers have been approved to work in Hong Kong SAR, China. By mid-2025, 10,000 non-local skilled workers are expected to be imported.7 The Group’s strategic expansion aligns with the growing demand for foreign labor accommodation in the Special Administrative Region.

Student Accommodation

As of 31 December 2024, the Group manages a portfolio of c.4,501 beds across 17 operational PBSA assets in Australia, the UK, the US, and China. Student housing demand and financial occupancies remain strong, driven by strong student numbers amidst a tight supply of beds in key university cities.

United Kingdom

In FY2024, the Group achieved a strong financial occupancy rate of 98%, up from 93% in FY 2023, reflecting sustained demand for quality PBSA beds. A persistent demand-supply imbalance continues to shape the market. According to CBRE, the UK currently faces a shortfall of 580,000 PBSA beds, with this gap expected to widen to 620,000 by 2029.8

Despite a 30% decline in total study-related visas issued last year9, demand for student housing remains resilient. Student demand is returning to a steady pre-pandemic growth trajectory supporting a positive long-term outlook for the sector10. Notably, 35,200 study visas were issued in December 2024, marking a 169% increase from November and a 15% YoY rise.9

Australia

The Group’s PBSA assets in Australia, comprising c.897 beds at dwell Village Melbourne City and dwell East End Adelaide, achieved an average financial occupancy of 96% in FY 2024, up from 88% in FY 2023.

While the proposed student cap has been withdrawn from parliamentary debate, government scrutiny on international student enrollment remains.11 The Group is closely monitoring and expects demand for PBSA beds to remain robust.

Rental rate growth for student accommodation in Melbourne and Adelaide continues to be healthy12, supporting a positive outlook for the sector. The PBSA sector in Australia has seen a steady growth in bed capacity over a decade, with 132,700 PBSA beds in 2024.13 PBSAs now house 6.4% of students, up from 5% in 2021, indicating steady growth in the purpose-built sector.14

The Group is actively expanding its PBSA footprint in Australia to address the ongoing supply-demand gap in the Australian PBSA market. At dwell Village Melbourne City, the Group is redeveloping an existing carpark into a new block with c.600 beds, with expected completion by 1Q 2026. The Group has also begun applications to seek planning approval for a land site in close proximity to RMIT University Melbourne to be developed into a new PBSA of c.575 beds.

In 2024, the Group acquired a 25% equity stake in a c.732-bed PBSA development in Macquarie Park, Sydney, which is set for completion by December 2025.

United States

The Centurion US Student Housing Fund (“CUSSHF” or “Fund”) reached term in November 2024, the Fund has sold dwell Tenn Street in 2Q 2023, and dwell Logan Square and dwell Stadium View in 2Q 2024. The remaining three assets maintain healthy occupancies and will be disposed of in due course.

Hong Kong SAR, China

The Group has begun leasing its student accommodation properties, dwell Prince Edward and dwell Ho Man Tin, totaling 155 beds. Occupancy is anticipated to ramp up over time as the current academic year is already underway.

Non-local student enrolment has been rising steadily, with a compound annual growth rate (CAGR) of 11.6% from 2018 to 2024, reaching 73,600 students in the 2023/24 academic year. With the doubling of the admission quota, enrolment is expected to increase to 80,000 in 2024/2515. Total PBSA supply is projected to reach 55,000 beds by 2028, but demand is expected to rise to 175,000 beds in the same year15, reinforcing the need for PBSA assets.

Build-To-Rent

In 2024, the Group expanded into a new specialised accommodation asset class, marking its maiden entry into China’s Build-to-Rent (“BTR”) market. This sector focuses on developing and managing properties specifically for long-term rental, catering to the growing demand for high-quality rental housing.

Xiamen, China

The Group’s first BTR project, located in Gaolin, Huli District, will be retrofitted into c.1,000 premium apartments targeted at fresh graduates and professionals in Xiamen. Approximately 400 units have been secured under 20-year master leases and commenced operations following retro-fitting works, in 2025. A second project, pending a master lease of 20 years to be secured, will offer c.500 high-quality apartments in a newly-built residential block.

Looking Ahead

The Group continues to seek opportunities to enlarge its portfolio of Assets Under Management across its living sector accommodation segments and geographically, including new markets such as China and the Middle East. Our focus remains on capital recycling and reallocation to drive growth in existing and new markets. This approach includes exploring asset-light models while selectively pursuing development opportunities that are strategically sound.

This includes a proposed transaction involving the establishment of a real estate investment trust (“REIT”) which will comprise some of the Group’s workers accommodation assets and student accommodation assets. As part of the proposed transaction, the Company is considering effecting a dividend in specie of some of the units in the proposed REIT held by the Company to shareholders of the Company.

Remarks:

1. Up to $53 billion in construction contracts expected in 2025: BCA, Straits Times, 23 Jan 2025

2. Dormitory Housing Index Report 2H 2024, Dormitory Association Singapore Ltd & Knight Frank Singapore, Feb 2025

3. Malaysia-foreign-worker-dependence-jobs-labour, Channel News Asia, 11 Jan 2024

4. With 2.5 million cap, Malaysia can only hire 90,000 more foreign workers by Dec despite labour shortages in plantations, Malay Mail, 5 Nov 2024

5. Restaurant groups urge govt to allow foreign worker hires, Free Malaysia Today, 22 Jan 2025

6. Good accommodation will attract workers to JS-SEZ - Johor Exco, The Sun, 18 Nov 2024

7. Plans afoot to import 10,000 non-local skilled workers, as 43,000 foreign laborers now work in HK, says labor minister, The Standard, 5 Feb 2025

8. Crisis or opportunity? The UK student housing shortage, CBRE, 4 Jul 2024

9. UK international student visa numbers on the up at last, Times Higher Education, 3 Feb 2025

10. Positive signals’ for UK international recruitment in September, Times Higher Education, 3 Feb 2025

11. Australia’s enrolment cap legislation is stalled. What happens next?, ICEF, 20 Nov 2024

12. Australian Student Accommodation 2024, Savills, Dec 2024

13. Student accommodation supply nearly doubles in last decade, Property Council of Australia, 27 Nov 2024

14. Report: international students not driving Australia’s housing crisis, The PIE, 7 Nov 2024

15. Bridging the Gap: Colliers Calls for Action on Hong Kong’s Student Housing Shortage, Colliers, 2 Sept 2024