This printed article is located at https://centurion.listedcompany.com/sus_investment-policy.html

Sustainable Investment Policy

As a leading provider of quality workers and student accommodation, Centurion Corporation Limited (CCL) is committed to sustainable growth with an emphasis on Environmental, Social and Governance (ESG) commitments. CCL is focused on taking proactive action in assessing potential portfolio risks and opportunities for sustainable investment decisions via its Sustainable Investment Policy (SIP).

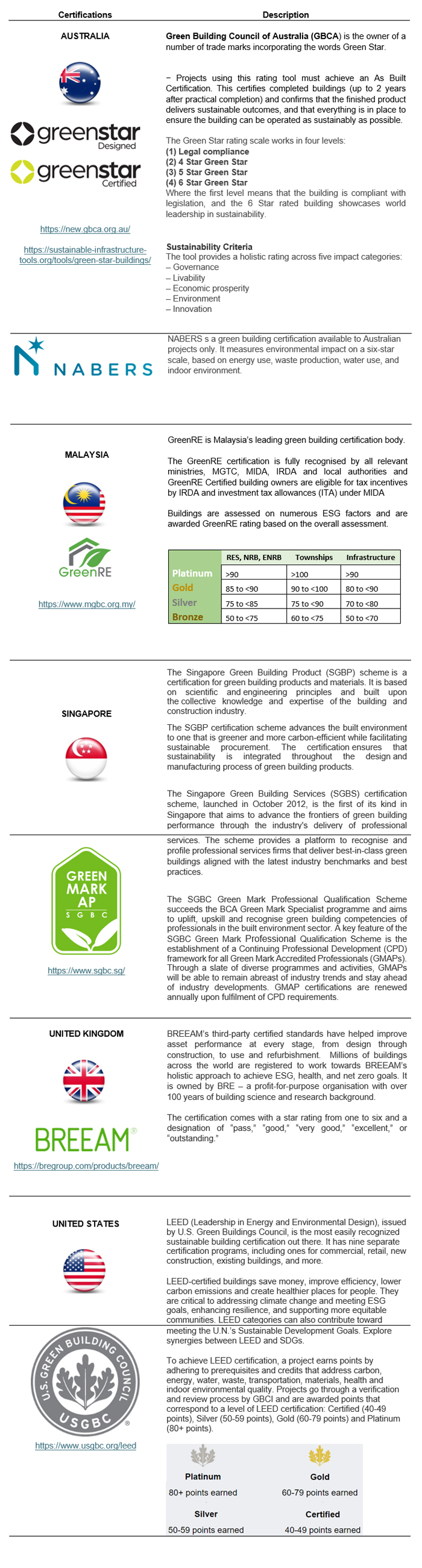

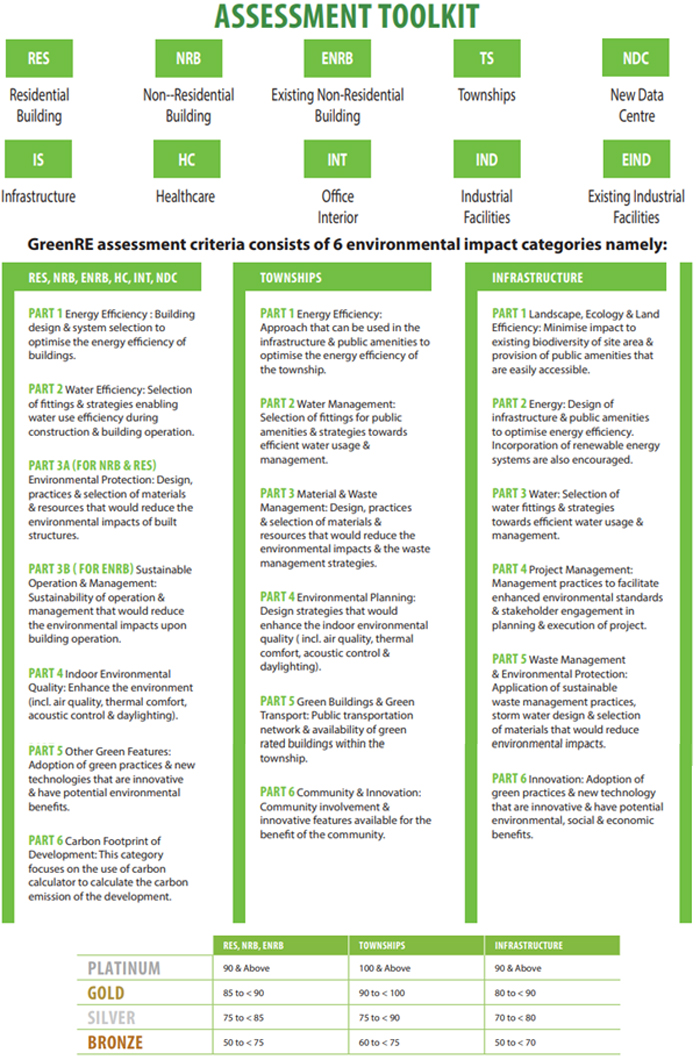

Sustainable developments and green buildings are a global priority today, which forms an integral part of CCL’s SIP. Investors, banks, insurers, and reinsurers are increasingly committing to ESG integration in their investment and portfolio assessments.

Scope

As a framework for assessing ESG issues, CCL incorporates the SIP as part of its due diligence to make informed decisions on its investments. This ESG factors listed below are non-exhaustive.

| Environment | Social | Governance |

|---|---|---|

|

|

|

Development

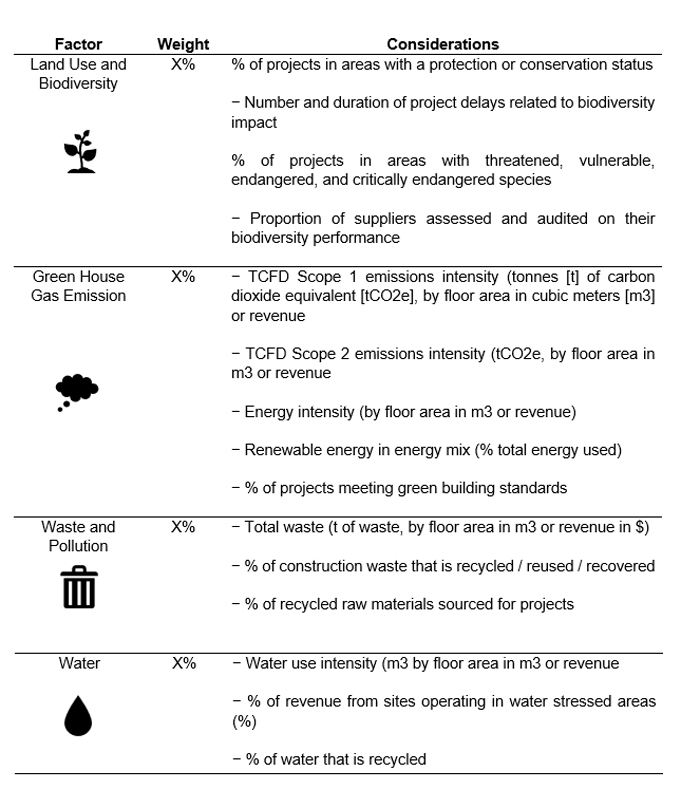

Land Use and Biodiversity is a key consideration in development projects with direct and indirect impact on the surrounding ecosystem, and is among the industry’s primary environmental impacts. GHG emission is also a major factor for consideration with high energy consumption during development as well as throughout the life of the building operation. During the development phase, hazardous and non-hazardous waste are generated and recycling and reusing of waste should be considered. Water usage efficiency is also an important consider during the development phase especially in water stressed areas.

Operating Assets

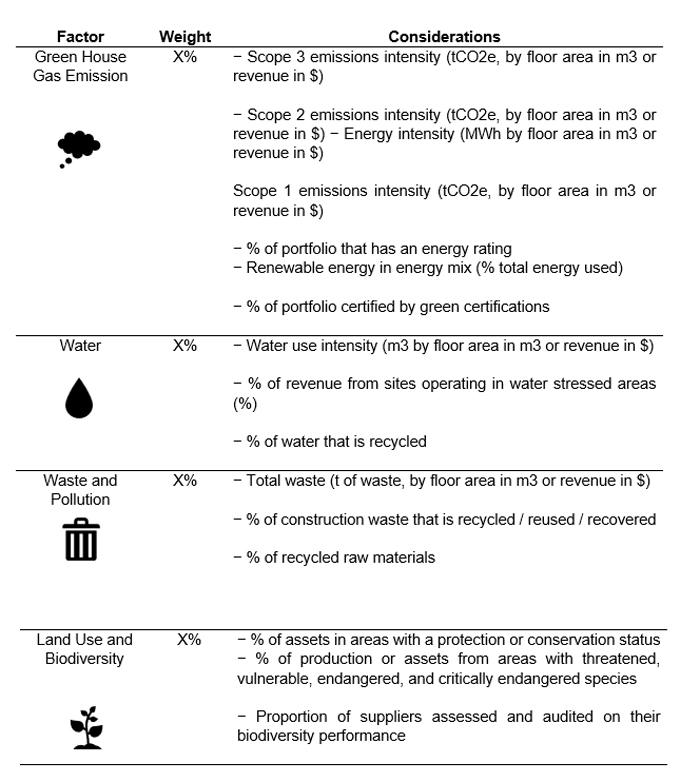

GHG emission is a key consideration of the operating asset over the lifetime of the building. Water efficiency is also an important factor as water stress can exacerbate impacts from tenant consumption, including industrial properties. Land use & biodiversity are less material for operating assets unless major greenfield expansion and/or refurbishment are expected.

Operating Assets

Building certifications will be an important consideration during the due diligence process for operating assets as part of regulatory requirement and also alignment to CCL’s sustainability goals. Additional CAPEX are to be considered for less efficient buildings to meet CCL’s ESG commitments.